FLYCAST BLOGS

Welcome to our blog, our team aims to publish helpful content on a (semi) regular basis . We're here to give you the best marketing content available, so think step by step guides, video tutorials and more. All specifically to benefit your UK business.

The Advancement of AI in Wealth Services

The wealth management industry stands at a pivotal inflection point. Artificial intelligence and AI personalisation have progressed well beyond the first-generation robo-advisors that emerged a decade ago, becoming sophisticated tools that amplify human advisors' capabilities rather than replacing them.Building Trust Through Personalised Communications

Wealth management firms today face unprecedented challenges and opportunities in marketing their services. As we move through 2025, the most successful wealth managers are those embracing innovative marketing approaches that combine technological advancement with the human touch that high-net-worth clients demand.

The Current State of AI Adoption in Financial Services

Artificial intelligence now offers you unprecedented capabilities to analyse vast amounts of data, automate routine tasks, and deliver highly personalised financial advice. AI is changing wealth management, and this shift represents one of the most significant technological disruptions in the industry's history.The Progression of Data-Driven Approaches in Private Equity

Private equity firms face unprecedented challenges today. Competition for quality deals has intensified, limited partners demand greater transparency, and macroeconomic headwinds continue to reshape market dynamics. The most successful firms have responded by changing their marketing and business development strategies from intuition-based to data-driven approaches.Real-Time AI Adapts Campaigns Automatically At Scale

UK businesses squander billions annually on poorly targeted marketing campaigns, which is a staggering inefficiency that few businesses could knowingly sustain in other operational areas. The culprit isn't simply poor strategy but rather the limitations of traditional marketing automation tools that lack the intelligence to adapt to complex customer behaviours, competitive shifts, and market dynamics.Redefining Results: AI’s Impact on Search

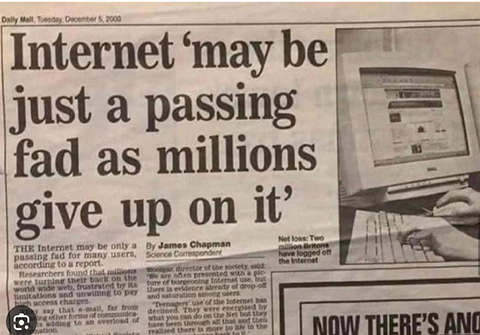

I started as an advertising account executive for Yellow Pages in 1989. It was a brilliant job – excellent money, solid corporate structure, clear mission, and advertisers genuinely received value for their investment. For years, we dominated local business discovery, and our thick directories were essential tools in every home and office.

Avoid the CRM Trap: Financial Features That Actually Matter

In the financial services industry, customer relationship management (CRM) systems have become indispensable tools for managing client interactions, streamlining operations, and driving growth. Using the right CRM, financial institutions can nurture relationships and secure new business opportunities.better traffic with robust

digital marketing strategies?

Take a closer look at our case studies or

see what our clients have to say about us here.

CASE STUDIES → CONTACT US →

"I can safely say they have brought in some serious business this year and in fact also one of our biggest customers to date.”

Tim Pat Dufficy. Founder, ServerSpace Limited

"The team took the time to really understand our requirements.

we’re now seeing a steady flow of quality leads at a much lower cost per acquisition”

Natalie Fayle. Melbourne Server Hosting

"We have now seen a steady uplift in traffic and we are confident both of our future returns and developing a cordial business relationship.”

Tim Price. Price Value Partners

"They stuck to deadlines, were very cost-effective, and delivered an impressive ROI.”

There was a significant increase in sales, close to 1000%.