ADVANCED PPC AUDIT STRATEGIES

FOR FINANCIAL SERVICES

A Structured Blueprint for Improving Your PPC Campaigns

Many firms waste significant portions of their digital marketing budget on ineffective PPC campaigns, which is where a PPC audit can really help you identify inefficiencies, correct any niggling overspend, and improve overall lead quality.

So whether you manage PPC campaigns for your hedge fund, investment firm, or fintech, our 11 step-by PPC audit guide will address the unique challenges of targeting sophisticated investors in the financial space and maximising returns for your business.

Let's dive into the eleven essential steps to improving your campaigns.

Step 1: Define Audit Goals Based on Business Outcomes Conversion tracking

Before diving into campaign specifics, you should establish clear objectives aligned with your financial firm's broader goals. Ask yourself what prompted this audit. Are you seeing escalating costs without a proportional increase in quality leads? Has the conversion rate for investor inquiries dropped? Are you struggling to track the ROI from your campaigns?

Document these objectives at the outset to focus your efforts and provide clear success metrics. With your goals clearly defined, you can examine how your account structure supports—or hinders—these objectives.

Step 2: Account Structure Analysis: Financial Services Framework

Start by examining how your current account reflects your business strategy:

- Service Segmentation: Have you created distinct campaigns for different financial offerings such as ESG funds, wealth management services, or fintech products?

- Audience Differentiation: Are campaigns separated by investor type (institutional, HNWI, retail) to allow targeted messaging?

- Keyword Term Division: Have you split campaigns between branded searches (people looking specifically for your firm), competitor terms, and generic financial queries?

- Geographic Separation: Are campaigns structured by relevant financial jurisdictions to accommodate different regulatory requirements?

Financial services firms require particularly disciplined structuring. Keep ad groups tightly focused with no more than 15-20 keywords each.

Group terms by investor intent rather than broad themes—investors searching for discretionary management services behave differently from those researching fintech platforms or passive investment options.

When reviewing your structure, watch for red flags like multiple financial products mixed in a single ad group or inconsistent naming conventions that obscure performance analysis.

Financial campaigns need clear separation between regulated and non-regulated offerings to maintain compliance and facilitate reporting.

This clarity will simplify ongoing management and help you quickly identify which strategies attract your most valuable prospects.

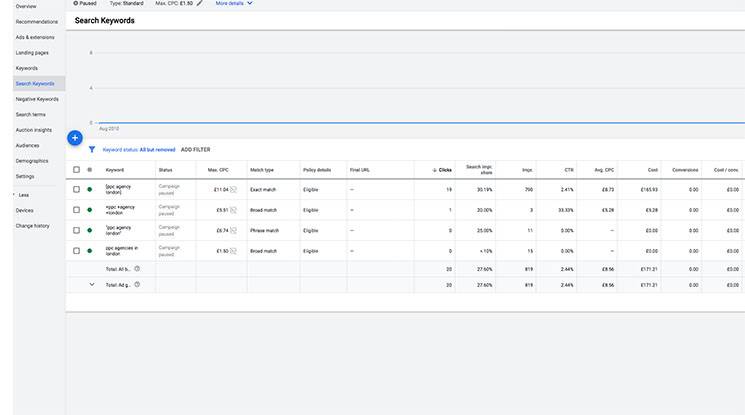

Step 3: Keyword & Search Term Optimisation for Financial Services

Begin by running a comprehensive Search Terms Report covering at least the past 90 days. This report will reveal what potential investors are actually typing when they find your ads.

Look for discrepancies between your intended targeting and actual search queries.

When reviewing your keyword strategy, focus on these key areas:

- Match Type Assessment: Are you using the right match types for different financial terms? While broad match can be useful for discovering new terminology your prospects use, phrase and exact match types generally outperform broad match for targeting specific investor intent.

- Search Term Analysis: What are people actually typing to find your ads? Are they qualified prospects or unintended traffic?

- Intent Mapping: Do your keywords align with different stages of the investor journey (research, comparison, decision)?

- Keyword Quality Scores: Are your most expensive financial terms achieving acceptable quality scores? Low scores on high-CPC terms dramatically increase campaign costs.

- Competitor Terms Strategy: How are you approaching competitor-branded searches? Are they worth the investment in delivering qualified leads or just expensive clicks?

- Specialist Financial Terminology: Are you capturing industry-specific terms your ideal investors might use? Technical financial language often signals sophisticated investors.

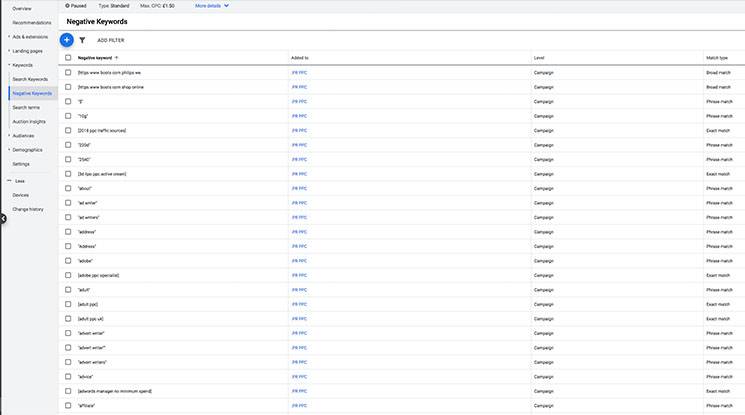

Negative keywords are particularly crucial for financial campaigns. You should create a robust negative keyword strategy to exclude terms like "jobs," "free," "cheap," "internships," and other phrases that might attract unqualified traffic.

Financial firms should be especially vigilant about excluding search terms that attract prospects below their minimum investment threshold.

Study your search terms report to identify negative keywords. Critical negative keywords for financial services include:

- Budget-focused terms: "affordable," "cheap," "free," "discount"

- Career-related searches: "jobs," "careers," "salary," "internship"

- Educational queries: "what is," "how does," "explain," "definition"

- Unqualified audiences: "student," "beginner," "start"

- Regulatory red flags: Terms that might trigger compliance concerns

There are also automated negative keyword discovery tools you can use, both free and paid which can offer further assistance in this regard.

After completing your keyword analysis, start implementing strategic changes: tighten match types where appropriate, expand negative keyword lists by campaign type, and reorganise keywords to better align with specific investor personas, financial products, and services.

Step 4: Budget Allocation Strategies for Financial Campaigns

Financial services firms often manage substantial ad budgets that demand strategic allocation. Your PPC audit should examine whether your budget distribution aligns with campaign performance and business goals.

Start by calculating the return on ad spend (ROAS) for each campaign and comparing cost per conversion across different segments.

Your budget allocation should account for both investor segments (who you're targeting) and intent stages (where they are in the decision process):

Investor Segments (examples):

- Institutional investors (pension funds, endowments)

- Family offices and UHNW individuals

- Financial advisors and intermediaries

- Retail qualified investors

Intent Stages:

- Top of funnel: Brand awareness, lead magnets, educational content

- Middle of funnel: Gated reports, whitepapers, client onboarding guides

- Bottom of funnel: Demo bookings, contact forms, allocator meetings

Awareness campaigns introducing financial products to new prospects will perform differently from conversion-focused campaigns targeting investors ready to schedule consultations. Each requires distinct budget parameters and performance expectations.

Identify high-performing campaigns that might be budget-constrained and underperforming campaigns receiving disproportionate funding.

In financial services, consider the lifetime value of different client types when assessing budget efficiency—acquiring a high-net-worth client often justifies a higher initial acquisition cost.

Financial markets also have distinctive seasonal patterns that should influence your budget planning.

Adjust allocations to account for Q1 reallocation cycles, tax year-end investment surges, ISA season, and typical Q3 investment slowdowns.

This temporal approach will ensure your campaigns receive appropriate funding during peak opportunity periods.

Step 5: Conversion Tracking & Attribution for Financial Services

Proper ">conversion tracking forms the bedrock of performance assessment, yet it's frequently implemented incorrectly in financial services campaigns. Without robust tracking, you cannot accurately evaluate which campaigns attract qualified investors versus those driving unqualified traffic.

Begin by verifying that all conversion actions are recording properly. For financial services firms, conversion events should align with meaningful business outcomes: consultation requests, investment prospectus downloads, webinar registrations, or direct contact from qualified investors.

Check that Google Tag Manager is correctly implemented and test each conversion path to confirm tracking accuracy.

Lots of financial firms track clicks but fail to properly implement call tracking—a significant oversight when many high-value investors prefer phone contact.

Attribution models require special consideration in financial services due to lengthy consideration cycles. Last-click attribution often undervalues upper-funnel awareness activities that introduce investors to your firm.

Consider implementing position-based or data-driven attribution models that better reflect the complex journey your high-value financial clients typically follow.

If you haven't done so already, also think about integrating your CRM system with your advertising platforms to track leads through to conversion for better insight into campaign quality.

Step 6: Campaign Settings & Bidding Strategies for Financial Markets

Campaign settings and bidding strategies can significantly impact who sees your ads and when. For financial services targeting sophisticated investors, these technical settings deserve careful scrutiny.

Begin by reviewing these critical campaign settings:

- Targeting Methods: Examine demographic parameters, particularly age, income brackets, and professional roles. Financial services often perform better with narrowly defined audience segments.

- Network Selection: Evaluate where your ads appear. Search Network typically delivers higher-intent traffic for investment services, while Display Network better supports brand awareness objectives.

- Ad Scheduling: Analyse when your ads deliver best results. For instance, C-suite executives might research investment options early mornings or evenings, while financial advisors might conduct research during mid-day hours.

Your bidding strategy should align with both campaign maturity and objectives:

- Manual CPC: Provides tight control for newer campaigns or niche financial services where data is limited

- Target CPA: Works well for established campaigns with consistent conversion patterns

- Target ROAS: Ideal for financial services with varying customer values or well-established conversion data

- Maximise Conversions: Appropriate when acquisition volume is more important than efficiency

The high value of financial services clients often justifies premium positioning for key terms, but this must be balanced against efficiency metrics. A financial advisor client worth £50,000 in lifetime value justifies a much higher CPC than a retail trading prospect.

Following your review, implement targeted improvements: adjust demographic parameters to focus on qualified investor profiles, refine ad scheduling to match peak engagement periods, and transition mature campaigns to appropriate automated bidding strategies while maintaining manual control over newer initiatives.

Step 7: Ad Copy Analysis for Financial Services

Ad copy for financial services must strike a delicate balance between compliance requirements, persuasive messaging, and clear value propositions. Poorly crafted ads can deter qualified investors or attract unsuitable prospects, wasting valuable budget.

Evaluate whether your ad copy articulates your unique investment approach or financial service differentiation. The financial ads should also speak directly to your potential investor's needs.

Compare click-through rates against conversion rates for each ad variation to identify which messages resonate with qualified prospects versus those that attract unqualified clicks.

Effective financial ad copy headlines should target specific investor segments with clear positioning:

- For Hedge Funds: "Market-Neutral Absolute Return Strategy for Institutional Investors"

- For Wealth Management: "Bespoke Portfolio Management for £1M+ Investments"

- For Investment Advisory: "Discretionary Management with Direct Portfolio Manager Access"

- For Fintech Platforms: "Institutional-Grade Trading Infrastructure with API Integration"

- For Fund Distribution: "Access to Exclusive Fund Managers Not Available Directly"

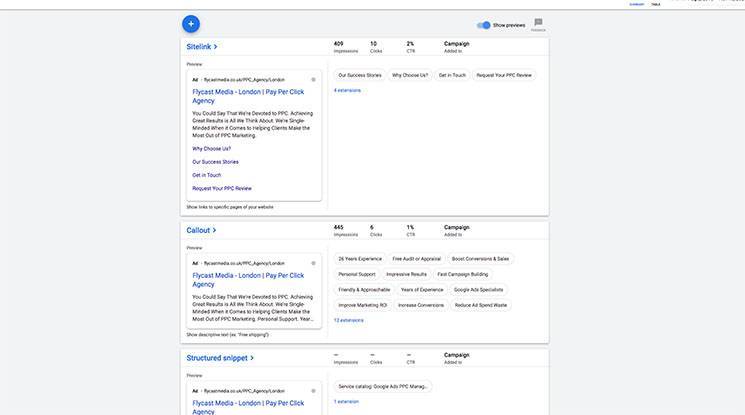

Review your implementation of ad extensions to significantly enhance your financial services ads:

- Sitelink Extensions: Link directly to "Meet the Investment Team," "Fund Performance," "Request Prospectus," or "Book Consultation"

- Callout Extensions: Highlight "FCA Regulated," "£500M+ AUM," "30+ Years Experience," or "Award-Winning Research Team"

- Structured Snippets: List "Services: Portfolio Management, Tax Planning, Estate Planning" or "Products: ETFs, Mutual Funds, SMAs"

- Price Extensions: Showcase "Minimum Investment: £250K," "Management Fee: 0.85%," or "Performance Fee: 20%"

- Lead Form Extensions: Enable direct inquiry submission for "Investment Consultation," "Fund Documentation," or "Webinar Registration"

Based on your analysis, develop new ad copy variations that address specific investor needs while highlighting your firm's distinctive approach.

Remove underperforming ads and test new messaging focused on your investment philosophy, performance track record, or client service model.

Step 8: Quality Score Optimisation for Financial Terms

Quality Scores can significantly impact both ad positioning and cost efficiency, which is why it's particularly important to focus on improvement wherever possible as financial services keywords often carry much higher costs-per-click than other industries.

For each core financial keyword, assess the three Quality Score components:

- Expected click-through rate: Evaluate against industry benchmarks.

- Ad relevance: Confirm alignment with search intent.

- Landing page experience: Review from the perspective of potential investors.

Financial services often score poorly on landing page experience due to compliance-heavy content or generic pages not aligned with specific ad messaging.

Side-note: Dedicated landing pages convert 65% better than standard website pages for PPC traffic.

Quality Score improvement strategies for financial services should focus on creating tightly themed ad groups around specific investment concepts, developing dedicated landing pages for key financial products or services, and ensuring page load speeds under three seconds.

Each landing page should directly address the search intent behind the corresponding keywords and provide clear next steps for interested investors.

Following your assessment, prioritise Quality Score improvements for your highest-cost, highest-volume financial keywords.

Target a Quality Score of at least 7 for core keywords to maximise positioning while minimising costs.

Create dedicated landing pages for primary investment offerings, improve page load speeds, and restructure ad groups around cohesive financial themes.

Step 9: Device & Location Targeting for Financial Audiences

Device and location targeting settings can dramatically impact campaign performance for financial services firms targeting specific investor demographics or geographical regions.

Analyse conversion rates and acquisition costs across different device types.

Financial decision-makers, particularly institutional investors and high-net-worth individuals, often conduct initial research on desktop devices rather than mobile. Review this data so you can make bid adjustments to prioritise higher-converting devices.

For location targeting, your financial firm should focus on regions with concentrations of your target investor profiles—such as London's financial district, affluent suburbs, or international financial centres where permissible under regulatory frameworks.

Consider excluding regions which offer little benefit and those outside your regulatory permissions to prevent compliance issues.

Based on your findings, implement strategic bid adjustments like increasing bids for desktop users in wealthy postcodes while potentially decreasing bids for mobile users in regions with limited qualified investor populations.

Step 10: Competitor & Market Analysis for Financial Services

Understanding competitor positioning provides valuable context for evaluating your own campaign performance and identifying market opportunities.

Conduct thorough competitive intelligence using tools such as:

Identify which competitors consistently appear alongside your ads and analyse their messaging approach.

For example, financial firms often differentiate based on Investment philosophy, performance track record, and fee structure

Examine whether competitors are bidding on your branded terms, potentially intercepting investors specifically searching for your firm.

Conversely, assess opportunities to target competitors' branded terms where permissible and strategically advantageous.

Use competitor analysis tools to uncover additional strategic insights and actionable tactics, including:

- Keyword Gap Analysis: Identify high-value keywords competitors rank for but you do not.

- Ad Copy Trends: Track competitors’ ad variations over time to determine which messaging strategies consistently appear, suggesting effective messaging.

- Budget Estimations: Evaluate competitors’ approximate monthly spend and adjust your budget to compete effectively in key areas.

- Display Ad Monitoring: Discover creative themes competitors use in display and remarketing ads, and identify opportunities to stand out.

- Landing Page Intelligence: Analyse competitor landing pages linked to PPC ads for conversion tactics, content strategies, and overall user experience to enhance your own landing page effectiveness.

Your own market analysis should also help identify undercapitalised financial search terms with high potential value. Look for emerging trends in investor searches that might signal new product opportunities or messaging approaches.

Step 11: Implementation Plan & Performance Monitoring

A comprehensive PPC audit provides valuable insights, but these insights create value only when systematically implemented and monitored. Create a structured implementation plan prioritising actions by potential impact and implementation complexity.

Organise your implementation priorities into three tiers:

- First: Address critical issues requiring immediate attention—such as broken conversion tracking, compliance concerns, or significant budget inefficiencies. These fixes typically deliver immediate performance improvements with relatively limited implementation effort.

- Next: Focus on high-impact optimisations implementable within 30 days, such as restructuring poorly organised campaigns, implementing strategic negative keywords, or adjusting bids on high-potential keywords. These changes typically deliver substantial performance improvements with moderate implementation effort.

- Finally: Schedule strategic improvements requiring more extensive resources or testing, such as developing new ad copy variations and A/B testing over an extended period, refining audience targeting, or creating new landing pages. While these initiatives may require greater investment, they often deliver sustained performance improvements over time.

Establish a clear performance monitoring framework to track the impact of your implemented changes. Define key metrics aligned with your initial audit goals and establish a regular reporting cadence.

Focus on lead quality metrics alongside standard performance indicators to ensure your campaigns attract qualified investors rather than merely generating volume.

Elevating Financial Services PPC Campaigns

A methodical PPC audit can provide you with a great signal-to-noise filter—trimming waste, sharpening messaging, and positioning your financial firm in front of qualified investors.

For most financial firms, implementing a quarterly audit schedule will provide an optimal balance between continuous improvement and operational efficiency. This will allow sufficient data accumulation between reviews while your PPC campaigns remain optimised as market conditions and investor preferences evolve.

Ready to Transform Your Financial Services PPC Performance?

At Flycast Media, we've spent 30 years refining performance campaigns in the financial services space. We understand investor psychology, institutional workflows, and the compliance-driven challenges of digital promotion.

Our team specialises in digital marketing for financial services firms, with particular expertise in PPC management for asset managers, investment houses, and fintech companies. We understand both the technical aspects of paid search and the specific requirements of financial marketing.

Shane McEvoy is a financial marketing expert with over 30 years' experience in digital advertising and financial services. He founded Flycast Media, a leading financial marketing agency, and has authored several influential guides and regularly contributes to respected industry publications - read his profile.