IS GOOGLE HAVING ITS

YELLOW PAGES MOMENT

TL:DR: 📈

- Google search decline: AI chatbots and LLMs siphon queries, shrinking SERP visibility.

- AI search adoption is soaring, giving early movers a massive edge in capturing high-intent finance leads.

- Future-proof your marketing by shifting budgets and content to AI-optimised channels, and protect your revenue as search habits evolve.

Redefining Results: AI’s Impact on Search

I started as an advertising account executive for Yellow Pages in 1989. It was a brilliant job – excellent money, solid corporate structure, clear mission, and advertisers genuinely received value for their investment. For years, we dominated local business discovery, and our thick directories were essential tools in every home and office.

Then something extraordinary happened. The internet arrived, and with it, Google.

Share this article:

The Yellow Pages Denial

What fascinates me about that period wasn't just the technological shift – it was the management response to early warning signs. In countless meetings throughout the 1990s, senior management relentlessly pushed paper directory sales over everything else. A peculiar form of natural selection emerged within the company.

The internet hit London first and hardest. Managers there began missing targets because their quotas remained anchored to print advertising whilst customers were already embracing web-based solutions. Meanwhile, managers in northern England and Wales continued hitting targets easily – their customers hadn't yet discovered the internet's potential.

This created a bizarre promotional pattern. Managers who succeeded in areas with lower internet adoption were promoted to southern offices. Soon, London was managed by executives who had thrived precisely because they hadn't adapted to digital change. We ended up with an echo chamber of leadership convinced that Yellow Pages directories remained supreme.

I vividly remember one meeting with a very senior manager who declared, in a thick northern accent: "Oh no, our customers are loyal. They understand we help them. They'll never move away from us."

I thought him utterly clueless. Customers were constantly seeking alternatives to what they perceived as our stranglehold monopoly. They resented our above-inflation price increases and would have relished any opportunity to abandon us entirely.

The Mobile Prediction That Was Ignored

Around 2006, I attended a business function in Manchester. As someone who worked extensively on the internet side of Yellow Pages at the time, I was speaking to a very senior manager about the future. I made the case that internet on mobile phones was inevitable – though I knew nothing about the coming iPhone.

I proposed that we should establish a partnership with O2, the UK mobile network provider, to ensure that the Yell.com search app shipped with every new phone they sold. I argued that even though data was expensive then, prices would come down dramatically, and we needed to be the first thing everybody used when they got their internet-enabled phone.

I was asked to write a report on this proposal. I did. It was ignored and disappeared without a trace.

This management attitude proved catastrophic. Later, Yellow Pages lost approximately 90% of its share price in a year as Google's impact became undeniable and pay-per-click advertising revolutionised how businesses reached customers.

Google's Current Challenge

Today, I believe Google faces a remarkably similar inflection point, and for financial services firms witnessing these seismic shifts in search behaviour, understanding how to adapt marketing strategies has become crucial. Forward-thinking organisations are already exploring how expert AI consulting services can help them pivot their digital strategies to capitalise on new search paradigms before their competitors catch on.

Google's Dominance and the First Cracks

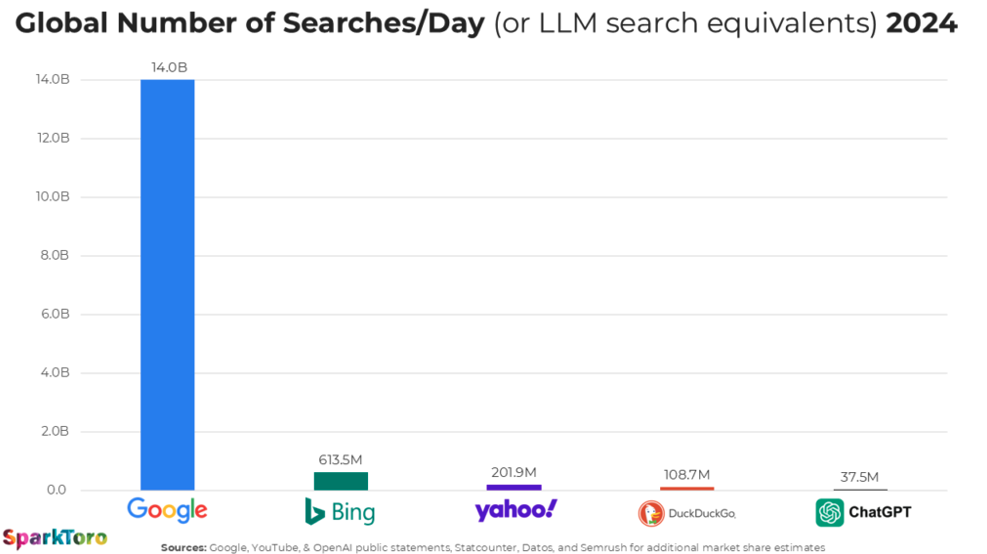

For nearly two decades, Google has maintained overwhelming search dominance – typically commanding over 90% of global search traffic. The scale is staggering:

- Google processes over 5 trillion searches per year (roughly 14 billion daily searches)

- As recently as 2024, Google's search query volume grew 21.6% year-on-year

- Google handled approximately 14.0 billion searches daily in 2024, dwarfing competitors

However, cracks are appearing. By Q4 2024, Google's global search engine market share fell below 90% for the first time since 2015, averaging around 89-90% through early 2025.

Source: https://www.adweek.com/media/googles-vulnerability-search/

More significantly, one investment analysis suggested that Google experienced its first year-on-year search volume decline in 22 years. Internal Google documents reveal that company executives believe search traffic decline is "inevitable" as users migrate to AI chatbots.

Source: https://searchengineland.com/google-search-traffic-decline-inevitable-455345

Google's leadership has reportedly urged urgent efforts to monetise AI-driven search features to offset this trend.

The Financial Stakes

Google's vulnerability is particularly acute because search advertising remains its financial foundation:

- In 2024, Google Search generated approximately $198 billion – roughly 61% of parent company Alphabet's total revenue

- About 77% of Alphabet's total revenue came from advertising in 2023

- Google Cloud services contribute only 10-13% of revenue, YouTube ads around 10%

Even a modest 5% decline in traditional search queries could translate to billions in lost advertising opportunities. Gartner analysts have predicted that traditional search engine volume could drop 25% by 2026 as AI chatbots gain popularity.

Source: https://datos.live/blog/predicted-25-drop-in-search-volume-remains-unclear/

The AI Revolution

The challenger this time isn't another search engine – it's artificial intelligence platforms that fundamentally reimagine how people seek information.

ChatGPT's Explosive Growth

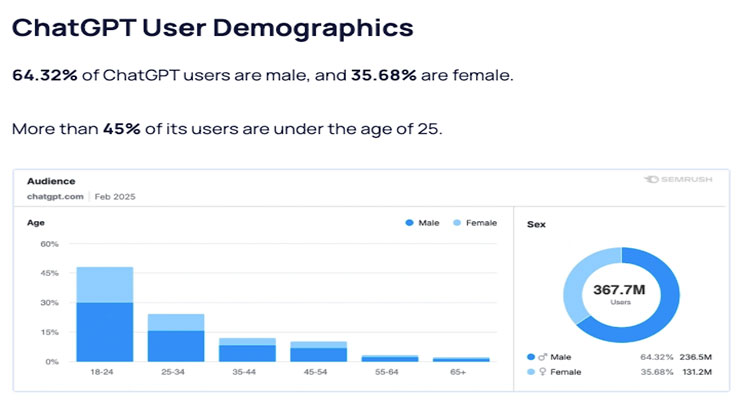

OpenAI's ChatGPT launched publicly in late 2022 and shattered all records:

- Achieved 100 million monthly users within just two months – the fastest-growing consumer application in history

- By December 2023, reached approximately 180 million users with 1.7 billion monthly site visits

- By late 2023, ChatGPT was handling about 1 billion messages per day from users

Source: https://explodingtopics.com/blog/chatgpt-users

Crucially, roughly 30% of ChatGPT prompts are search-like information requests. Users ask for travel advice, product comparisons, and explanations where they might previously have "Googled it."

By 2024, ChatGPT was handling an estimated 37 million search-equivalent queries daily.

The Growing AI Search Ecosystem

Other AI platforms are gaining significant traction:

Perplexity AI: An LLM-powered search engine that directly answers queries with cited sources:

- Handled about 250 million queries in July 2024 alone (half its total for all of 2023)

- By May 2025, was seeing roughly 780 million queries per month (approximately 26 million searches daily)

- Reached about 15-22 million active users by 2025

Source: https://www.justthink.ai/blog/perplexitys-780m-monthly-queries-signaling-the-ai-search-revolution

Microsoft Bing Chat: Microsoft integrated AI chat (powered by OpenAI's GPT-4) into Bing Search:

- Bing's overall search share has ticked up to around 4% globally

- In 2023, Bing.com saw about a 6% increase in its share of the search audience

- However, only an estimated 4-9% of Bing users engaged with the chatbot monthly

Source: https://gs.statcounter.com/search-engine-market-share

Google's Bard/Gemini: Google launched its own conversational AI in response:

- Despite a rocky start, by early 2025 Google's Gemini had become the second-largest AI search tool by usage (behind ChatGPT)

- Google's CEO noted that AI summaries in search led to increased search usage among testers

- However, AI overviews often reduce clicks on results – one study saw a 70% drop in clicks when AI answers were present

Changing User Behaviour

The evidence of behavioural shift is compelling and mirrors the early internet adoption that Yellow Pages ignored:

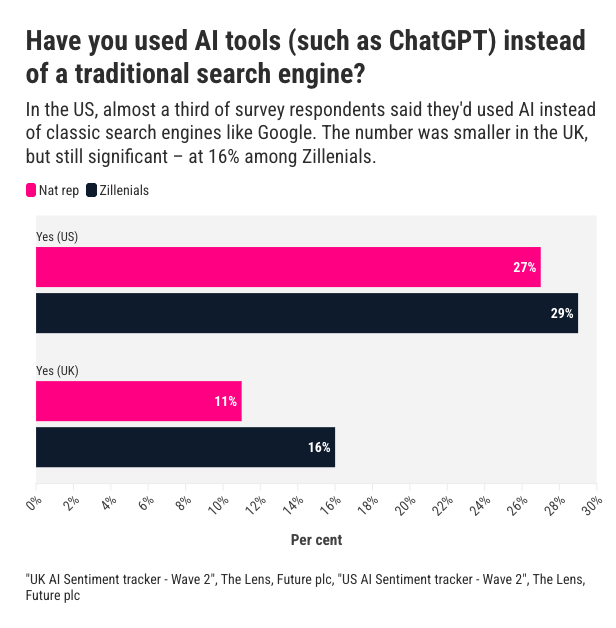

Consumer Survey Data

A December 2024 survey revealed dramatic shifts in search behaviour:

- 27% of US respondents now use AI tools like ChatGPT instead of search engines

- 13% of UK respondents have made the same switch

Usage Patterns

A March 2025 study by Elon University found:

- Over half (52%) of US adults have now used an AI chatbot or large language model

- Among those users, two-thirds use these AI tools like search engines for finding information

- "Using them as a search engine" was the single most common use-case

- 34% of LLM users engage with an AI tool daily

High-Value Query Migration

Interestingly, whilst AI search currently represents only 0.5% of total web traffic, it generated 12% of all conversions in one study – suggesting AI-driven searches convert 23 times higher than ordinary search visits.

Source: https://ppc.land/ahrefs-study-finds-ai-search-visitors-convert-23x-higher-than-organic-traffic/

This implies users turn to AI for more complex, high-intent queries where they're more likely to take action – exactly the type of valuable searches that drive advertising revenue.

Zero-Click Search Acceleration

Even before AI, Google was seeing increased "zero-click searches" where users get their answers without clicking through to websites. An estimated 58% of Google searches already ended without a click, and AI snippets are accelerating this trend.

Source: https://writesonic.com/blog/chatgpt-impact-on-google-search-traffic

Personal Experience and Client Observations

Anecdotally, I've witnessed this shift firsthand at Flycast Media. When I now ask new clients how they discovered our financial marketing services, just the last three initially said "Google" – but when pressed, they clarified they meant AI search through ChatGPT. One specifically mentioned using ChatGPT Deep Research to find us, and this year many have just said "AI".

Personally, I've largely abandoned traditional Google searching. While Google now displays AI responses atop search results, I find them less satisfactory than dedicated AI platforms. Instead of searching "best snowboard boots," I'll ask Perplexity or ChatGPT to "find reviews of the best snowboard boots and rank them by importance and review quality."

This mirrors the anecdotal evidence that Yellow Pages management dismissed in 1994. Early adopters were already changing behaviour, but leadership refused to acknowledge the implications.

Market Share Reality Check

It's crucial to note that Google still vastly outnumbers competitors in raw search volume:

- Google: ~14 billion searches per day

- Bing: ~613 million searches per day

- ChatGPT: ~37.5 million search-like queries per day

- All AI tools combined likely account for under 2% of search queries in 2024

However, focusing only on current volume misses the rapid trend and strategic threat. AI platforms have exploded from zero to millions of queries in just two years, and they're changing how people search in ways that could significantly impact Google's growth.

Early 2023 to 2024 data showed Google's share of combined traffic (with Bing, Yahoo, OpenAI) dipped from 91.5% to 90.7%. By late 2023, around 18% of online users had tried ChatGPT at least once in a month, up from essentially zero a year prior.

Can Google Adapt?

Google isn't static. The company is investing heavily in AI integration, attempting to evolve search whilst retaining users within its ecosystem. Early testers of Google's AI search reportedly conduct more searches thanks to conversational follow-ups, and Google's Gemini has achieved notable usage behind ChatGPT.

However, history demonstrates that incumbents often struggle with disruptive change – the classic Innovator's Dilemma. Google's revenue model depends on the traditional approach of ad-supported result lists. AI answers don't naturally generate the same ad volumes or clicks, creating a potential scenario where Google executes perfectly on technology integration but still sees revenue per search decline.

This parallels Yellow Pages' eventual online directory development. They built digital products, but found them far less profitable than their printed directories. The business model that made Yellow Pages dominant couldn't translate to the new medium.

The Yellow Pages Parallel

The similarities are striking. Both companies dominated information discovery in their respective eras. Both faced new technology that fundamentally changed user expectations. Both had entrenched revenue models threatened by the disruption.

Yellow Pages executives dismissed early internet adoption as a temporary novelty. They believed customer loyalty would prevail over convenience and capability. They ignored prescient warnings about mobile internet. They were catastrophically wrong.

Google's leaders appear more aware of the threat. CEO Sundar Pichai has called 2025 a "critical" year for Google's AI strategy, and internal discussions acknowledge the need to match ChatGPT's popularity.

The Verdict

Is Google having its Yellow Pages moment? The evidence suggests yes – though the outcome isn't predetermined.

Google faces measurable user migration to AI platforms, first-ever market share declines, and internal acknowledgement that traditional search traffic loss is "inevitable." User expectations have evolved toward natural language responses and conversational assistance – areas where large language models excel.

The question isn't whether change is coming, but whether Google can successfully navigate the transition. If it integrates AI effectively whilst maintaining its position as the default information gateway, Google could emerge stronger. But if it underestimates the pace of change or fails to deliver AI experiences comparable to independent rivals, we might witness a steady erosion of Google's empire.

Yellow Pages once seemed unassailable. The thick directories were ubiquitous, trusted, and profitable. Yet within a few years of widespread internet adoption, they became largely irrelevant.

Google's search empire, whilst vast and currently profitable, isn't immune to the same forces of creative destruction. The company that displaced Yellow Pages now faces its own potential displacement.

History suggests that no technological giant's reign lasts forever when genuine innovation emerges. Google's challenge is ensuring that "Google it" remains as natural in 2030 as it was in 2010 – and that it doesn't become the next cautionary tale of disruption in the digital age.

The stakes couldn't be higher, and both precedent and current trends indicate that the battle for the future of information discovery is just beginning.

About the Author

Shane Mcevoy brings three decades of digital marketing and data strategy expertise to financial services as Managing Director of Flycast Media, architecting data-driven strategies for asset managers, fintech companies, and hedge funds. His experience spans from early online directories to modern AI solutions, bridging technical execution with business strategy. Shane has authored several influential guides, regularly contributes to respected industry publications, and speaks at financial conferences in the UK.